499/- only for first 100 traders

Here’s how we deliver Pine Script development & automation, inspired by the referenced vendors but customised for your PACPL brand and target audience (Indian retail + algo-marketplaces).

• We engage with you to capture your trading logic: conditions for entries/exits, risk parameters (stop-loss, target, trailing), hedging, multi-leg trades, time-frames, instruments (e.g., Nifty options, stocks, MCX, etc.).

• Define environment assumptions: intraday vs positional, data frequency, broker linkage, alerting mechanism.

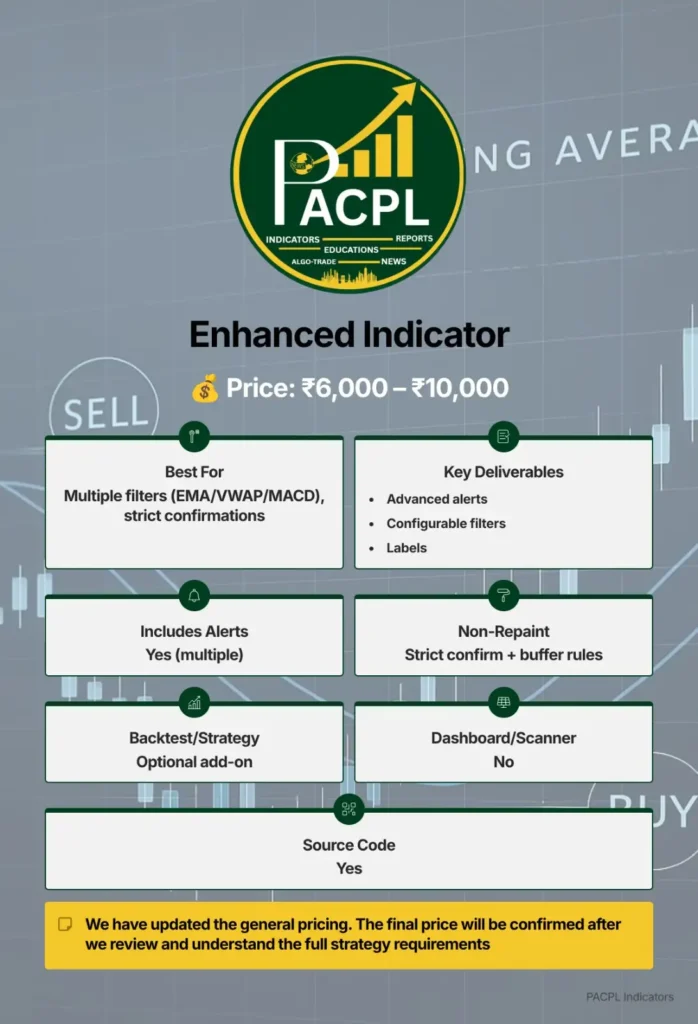

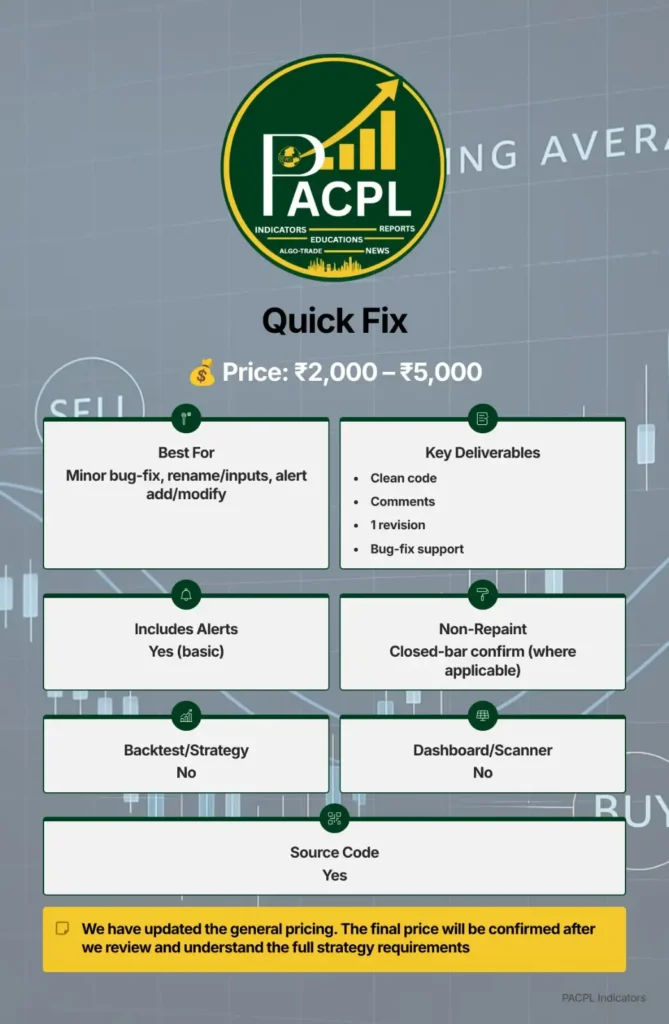

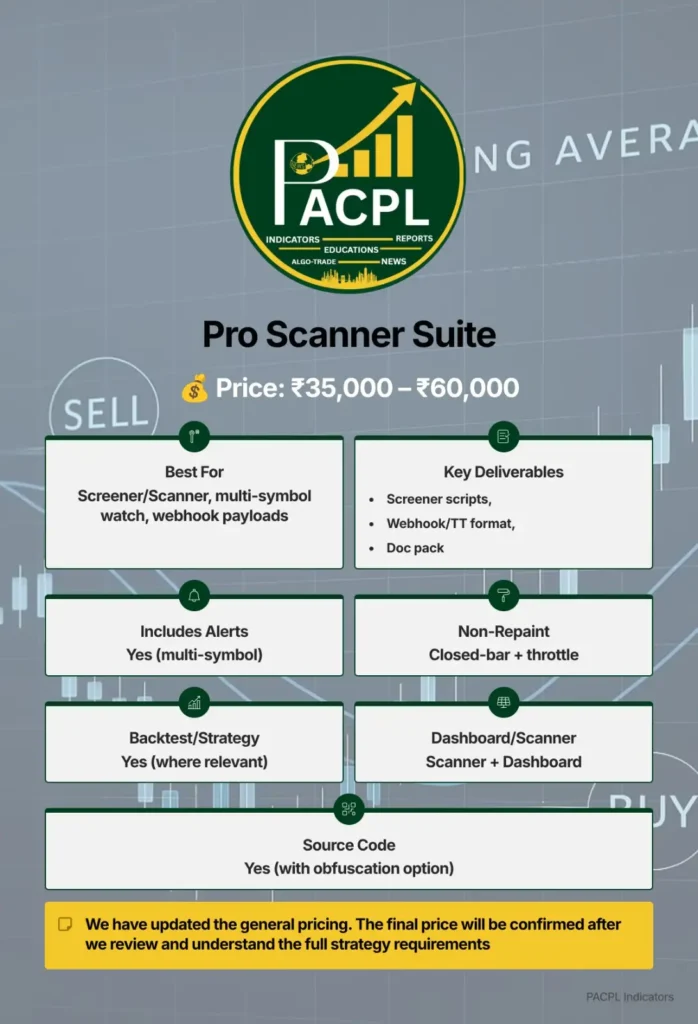

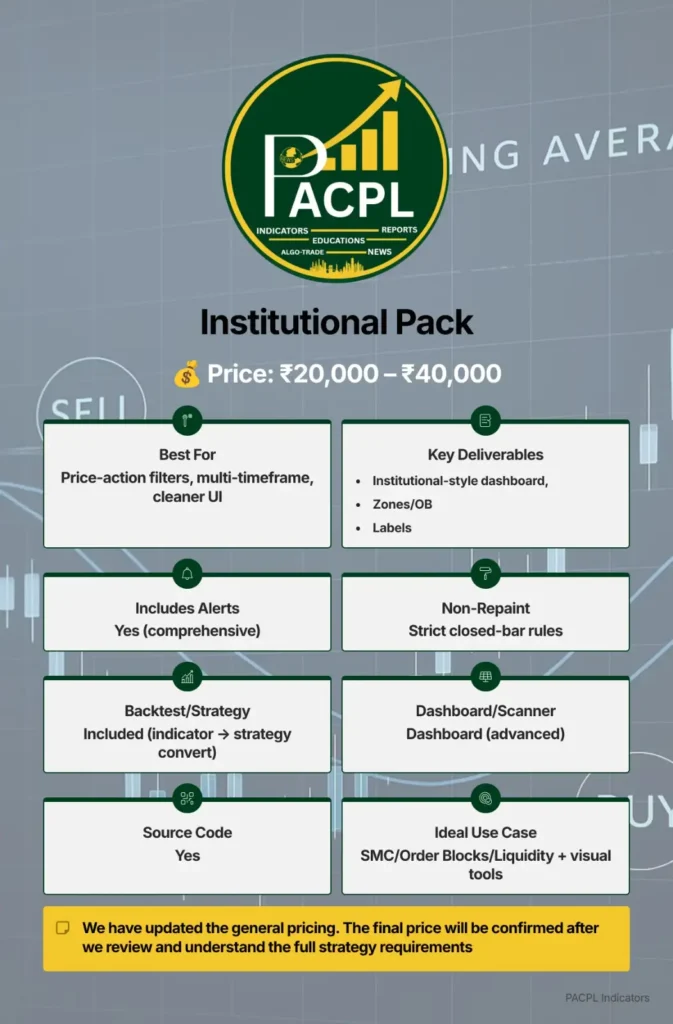

• Estimate complexity → assign tier of execution (see pricing tiers below).

• Convert your logic into Pine Script: custom indicator or full strategy (with built-in back-test capabilities).

• Use Trading View’s Strategy Tester (win-rate, drawdown, profit factor) to validate logic.

• Ensure non-repainting logic, correct handling of historical/back-test vs live.

• Provide version control and documentation of the code.

• Set up alerts on Trading View (web-hook payloads) that trigger the strategy’s signals.

• Provide integration with broker/execution tool (API/bridge) so alerts flow into live orders.

• Seamless link between Trading View & your execution platform

• Deploy the Pine Script on live charts; monitor performance in forward-testing ("paper trade") mode first.

• Provide support for minor tweaks and adjustments (parameter optimisation, logic fine-tuning).

• Provide documentation/hand-over of source code, alert instructions, and operational manual.

• For advanced clients/trading systems: Multi-leg logic, time-based/multi-symbol strategies, hedging, real-time monitoring dashboards.

• Preparing scripts for marketplace listing (e.g., Tradetron, etc.), with proper input parameters, user-friendly GUI, documentation.

To deliver efficiently, we expect you to supply:

A clear description of your trading logic (entry, exit, stop/target/management, time-frame, instruments).

Any historical performance/logic you already have (or sample trades).

Decision on automation scope: alert only? alert + broker execution? which brokers?

Desired UI/parameters: do you need user-inputs, multi-legs, hedging, re-entries?

Acceptable delivery timeline and budget.

Access to your TradingView account (or a test account) for integration/alerts.

Pine Script runs in TradingView. For full automation (order execution), we link/bridge alerts to your broker-API so trades are triggered automatically.

Yes — TradingView has in-built Strategy Tester for Pine Script. We ensure you see key stats (win-rate, drawdown, profit factor) before live deployment.

An indicator provides visual cues (plots, signals), but cannot always be used for full automation/back-test. A strategy defines explicit entry/exit rules, computes performance metrics, and is automation-ready.

Yes — we cater to Indian markets (cash/derivatives/commodities) and also global markets if required. We can build for multi-leg options, hedge strategies etc

Yes — you receive the Pine Script source code, documentation, and full control (unless otherwise agreed). We ensure proper hand-over.

We’re here to help. Reach out today and get the support you need to take your trading to the next level!

One platform combining Momentum, Reversal, and Swing indicators.

Address: 03, Signet Plaza Tower-B, Third floor, Kunal cross road, Gotri, Vadodara- 390021

WhatsApp us